Transaction Advisory Services Can Be Fun For Everyone

Table of ContentsGetting The Transaction Advisory Services To WorkIndicators on Transaction Advisory Services You Should KnowThe Single Strategy To Use For Transaction Advisory ServicesSome Known Incorrect Statements About Transaction Advisory Services Excitement About Transaction Advisory Services

This action makes sure the business looks its best to prospective customers. Obtaining the organization's worth right is crucial for a successful sale.Transaction consultants action in to assist by obtaining all the required information organized, answering inquiries from buyers, and organizing check outs to the business's area. Transaction experts utilize their proficiency to assist business proprietors deal with difficult arrangements, fulfill customer expectations, and framework offers that match the proprietor's goals.

Fulfilling legal regulations is important in any kind of business sale. They assist organization owners in preparing for their following actions, whether it's retired life, starting a new endeavor, or handling their newly found wealth.

Deal consultants bring a wealth of experience and expertise, making sure that every facet of the sale is dealt with skillfully. Via calculated prep work, valuation, and negotiation, TAS assists company proprietors attain the greatest feasible list price. By making certain legal and regulatory compliance and managing due diligence alongside various other deal employee, deal experts minimize prospective dangers and responsibilities.

Not known Details About Transaction Advisory Services

By comparison, Large 4 TS groups: Work with (e.g., when a prospective customer is performing due persistance, or when an offer is closing and the buyer requires to incorporate the business and re-value the seller's Annual report). Are with costs that are not linked to the deal closing efficiently. Make charges per involvement someplace in the, which is much less than what investment banks make even on "small bargains" (however the collection likelihood is likewise much greater).

The interview questions are very similar to investment banking interview inquiries, yet they'll concentrate a lot more on accountancy and assessment and less on topics like LBO modeling. Anticipate inquiries concerning what the Change in Working Funding methods, EBIT vs. EBITDA vs. Net Income, and "accounting professional just" subjects like trial equilibriums and exactly how to walk through occasions making use of debits and credit reports instead of monetary statement adjustments.

Our Transaction Advisory Services Ideas

Specialists in the TS/ FDD groups might also speak with administration regarding whatever Learn More above, and they'll write an in-depth record with their searchings for at the end of the procedure.

The pecking order in Deal Services varies a little bit from the ones in financial investment financial and personal equity jobs, and the general form looks like this: The entry-level role, where you do sites a great deal of information and monetary analysis (2 years for a promotion from here). The following level up; similar work, but you obtain the more interesting bits (3 years for a promo).

Specifically, it's tough to get advertised past the Manager degree since few individuals leave the job at that phase, and you need to begin showing evidence of your ability to generate profits to development. Let's begin with the hours and lifestyle given that those are simpler to explain:. There are occasional late nights and weekend job, but absolutely nothing like the frantic nature of financial investment banking.

There are cost-of-living changes, so expect lower payment if you're in a cheaper place outside significant financial (Transaction Advisory Services). For all settings other than Companion, the base pay makes up the bulk of the overall settlement; the year-end perk may be a max of 30% of your base salary. Usually, the most effective method to boost your revenues is to switch over to a different company and discuss for a greater wage and useful source benefit

8 Easy Facts About Transaction Advisory Services Explained

You might enter into corporate advancement, but investment financial obtains extra hard at this phase due to the fact that you'll be over-qualified for Expert functions. Corporate finance is still an alternative. At this phase, you need to just remain and make a run for a Partner-level duty. If you wish to leave, possibly relocate to a client and do their valuations and due persistance in-house.

The primary issue is that due to the fact that: You typically need to sign up with one more Big 4 team, such as audit, and job there for a couple of years and afterwards relocate into TS, job there for a few years and after that relocate into IB. And there's still no warranty of winning this IB role due to the fact that it depends upon your region, customers, and the employing market at the time.

Longer-term, there is also some danger of and because reviewing a firm's historical economic information is not specifically rocket scientific research. Yes, people will certainly always require to be included, yet with advanced innovation, reduced headcounts might possibly support customer engagements. That claimed, the Transaction Solutions team beats audit in regards to pay, work, and departure opportunities.

If you liked this post, you might be curious about reading.

Not known Details About Transaction Advisory Services

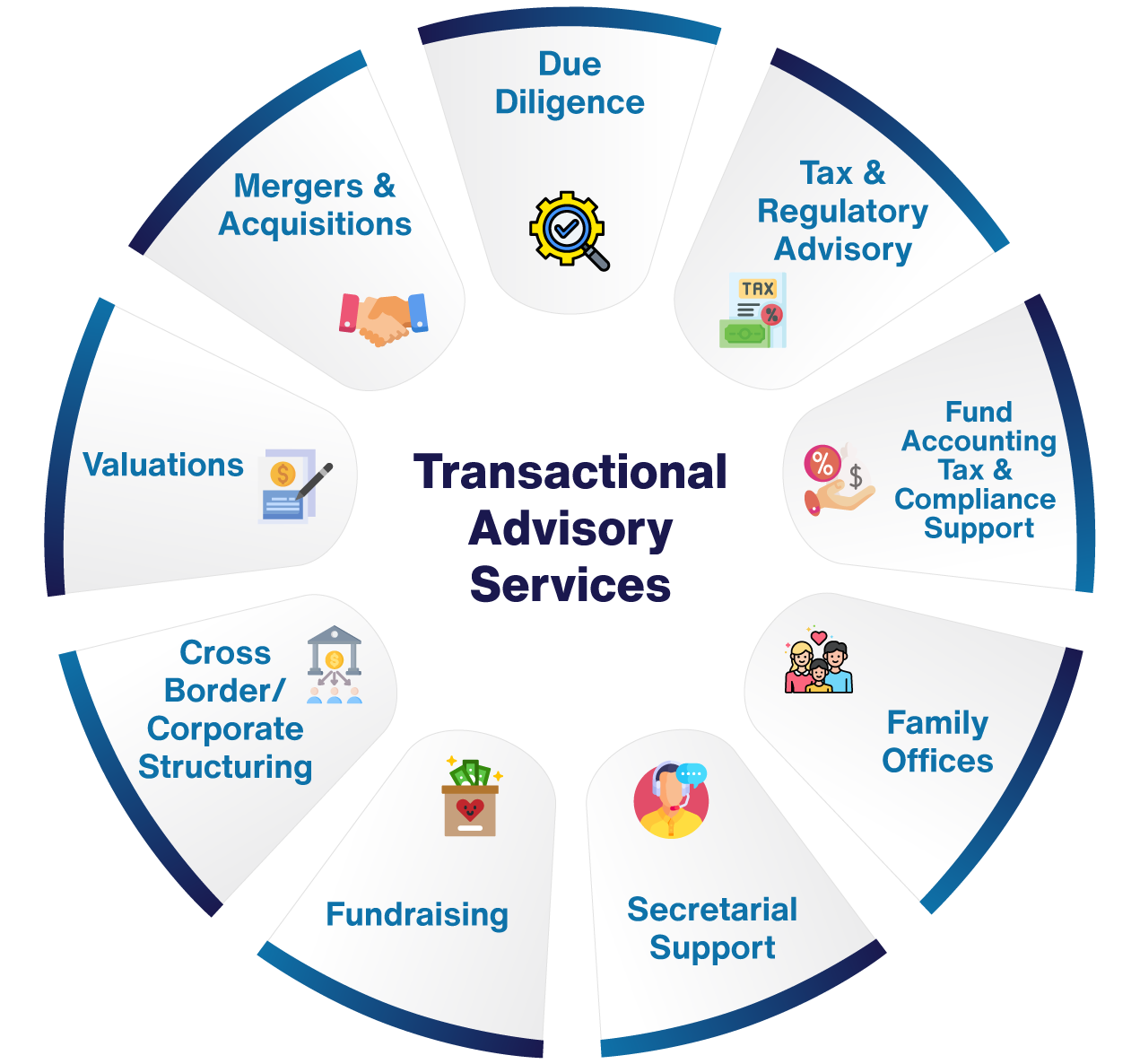

Create advanced economic frameworks that help in identifying the actual market price of a company. Give advising work in relation to business valuation to aid in negotiating and prices structures. Explain one of the most appropriate form of the deal and the sort of consideration to employ (cash money, stock, earn out, and others).

Execute combination preparation to identify the procedure, system, and organizational modifications that might be needed after the bargain. Set guidelines for incorporating departments, modern technologies, and business procedures.

Examine the possible consumer base, industry verticals, and sales cycle. The operational due persistance provides vital insights into the functioning of the firm to be acquired concerning risk assessment and value creation.